All Categories

Featured

Table of Contents

With a variable annuity, the insurance firm buys a portfolio of common funds chosen by the customer. The efficiency of those funds will certainly determine just how the account expands and just how big a payout the buyer will ultimately get. Individuals that pick variable annuities want to take on some level of danger in the hope of generating bigger profits.

If an annuity purchaser is married, they can choose an annuity that will proceed to pay earnings to their partner need to they die. Annuities' payouts can be either immediate or deferred. The basic question you require to take into consideration is whether you desire routine income currently or at some future day.

A deferred payment permits the money in the account even more time to expand. And similar to a 401(k) or an individual retired life account (INDIVIDUAL RETIREMENT ACCOUNT), the annuity proceeds to gather incomes tax-free up until the money is withdrawn. Over time, that could accumulate into a substantial sum and cause larger payments.

With a prompt annuity, the payouts start as quickly as the buyer makes a lump-sum repayment to the insurer. There are some various other important choices to make in acquiring an annuity, depending upon your situations. These consist of the following: Buyers can schedule settlements for 10 or 15 years, or for the remainder of their life.

Decoding Fixed Annuity Vs Equity-linked Variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Benefits of Variable Annuities Vs Fixed Annuities Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Fixed Index Annuity Vs Variable Annuities Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Annuity Vs Fixed Indexed Annuity A Closer Look at How to Build a Retirement Plan

That could make sense, for instance, if you require an income boost while paying off the last years of your home mortgage. If you're married, you can pick an annuity that pays for the remainder of your life or for the rest of your spouse's life, whichever is much longer. The last is often described as a joint and survivor annuity.

The selection between deferred and instant annuity payouts depends mostly on one's cost savings and future incomes objectives. Immediate payments can be helpful if you are already retired and you require an income to cover daily expenses. Immediate payouts can start as quickly as one month into the acquisition of an annuity.

Individuals generally get annuities to have a retirement revenue or to construct cost savings for one more purpose. You can get an annuity from a qualified life insurance policy representative, insurance firm, economic coordinator, or broker. You ought to chat to an economic adviser concerning your demands and objectives before you buy an annuity.

The difference in between the 2 is when annuity payments begin. permit you to save money for retirement or various other factors. You don't need to pay tax obligations on your earnings, or payments if your annuity is a specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT), until you take out the earnings. permit you to produce an income stream.

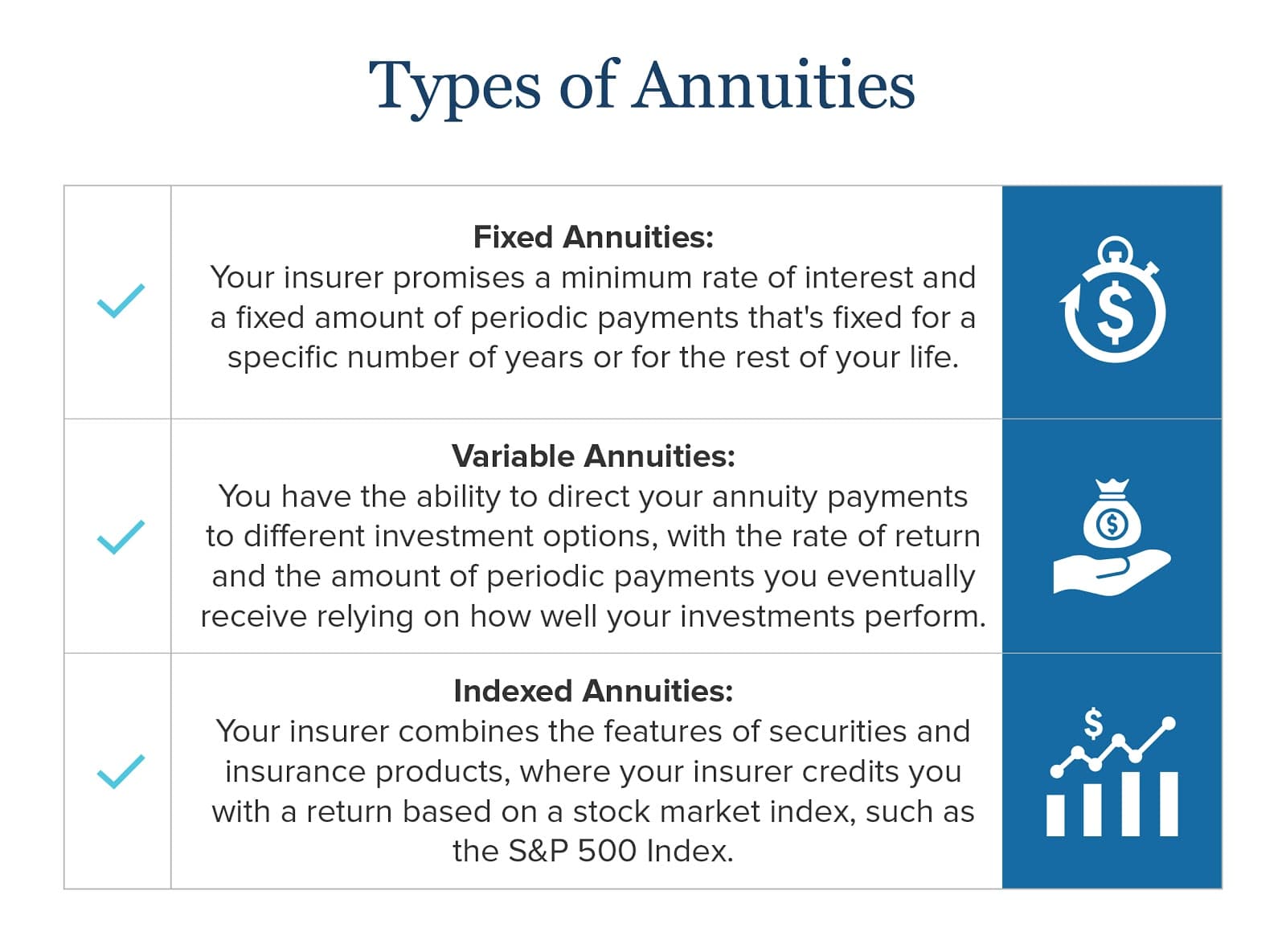

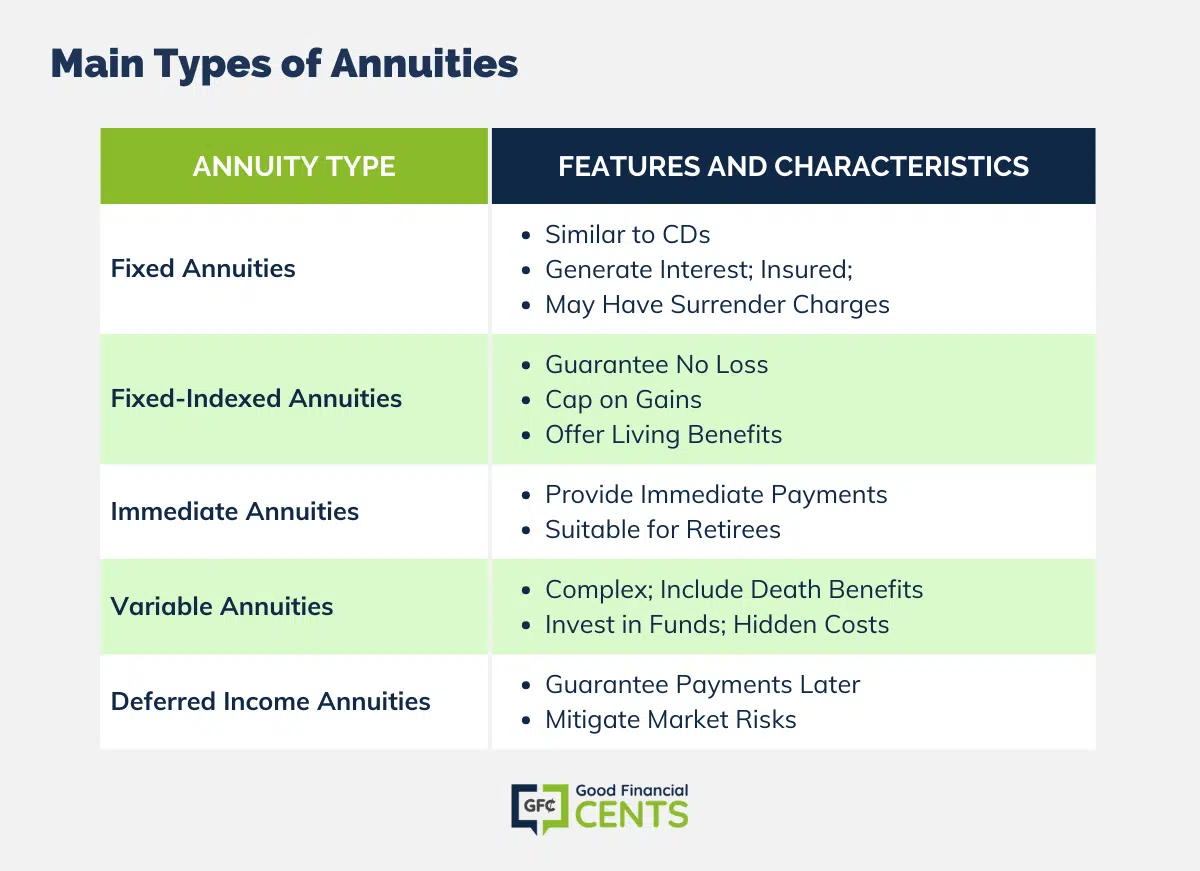

Deferred and prompt annuities use several choices you can pick from. The options provide various levels of possible danger and return: are ensured to gain a minimal passion price.

allow you to choose between sub accounts that are comparable to common funds. You can gain extra, yet there isn't an assured return. Variable annuities are higher threat due to the fact that there's an opportunity you can shed some or all of your cash. Fixed annuities aren't as risky as variable annuities because the financial investment danger is with the insurance policy company, not you.

Understanding Fixed Vs Variable Annuity Pros Cons Everything You Need to Know About Financial Strategies Breaking Down the Basics of Deferred Annuity Vs Variable Annuity Features of Fixed Income Annuity Vs Variable Annuity Why Fixed Indexed Annuity Vs Market-variable Annuity Matters for Retirement Planning What Is A Variable Annuity Vs A Fixed Annuity: How It Works Key Differences Between Fixed Annuity Vs Variable Annuity Understanding the Risks of Fixed Income Annuity Vs Variable Growth Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Income Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing Fixed Index Annuity Vs Variable Annuities Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuities

Set annuities guarantee a minimal rate of interest price, normally between 1% and 3%. The business may pay a greater passion rate than the assured interest price.

Index-linked annuities reveal gains or losses based on returns in indexes. Index-linked annuities are more intricate than dealt with delayed annuities. It is necessary that you understand the attributes of the annuity you're thinking about and what they indicate. The 2 legal attributes that affect the quantity of passion attributed to an index-linked annuity one of the most are the indexing approach and the engagement price.

Decoding Fixed Index Annuity Vs Variable Annuity Key Insights on Variable Vs Fixed Annuity Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuity Features of Tax Benefits Of Fixed Vs Variable Annuities Why Fixed Vs Variable Annuity Pros And Cons Is Worth Considering Fixed Index Annuity Vs Variable Annuity: How It Works Key Differences Between Annuities Fixed Vs Variable Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Each relies on the index term, which is when the company computes the interest and credit ratings it to your annuity. The identifies just how much of the increase in the index will certainly be utilized to calculate the index-linked passion. Various other crucial functions of indexed annuities consist of: Some annuities top the index-linked rate of interest.

The flooring is the minimum index-linked rate of interest you will make. Not all annuities have a flooring. All taken care of annuities have a minimum guaranteed value. Some business utilize the standard of an index's worth as opposed to the value of the index on a defined date. The index averaging may occur at any time during the regard to the annuity.

Exploring the Basics of Retirement Options Everything You Need to Know About Deferred Annuity Vs Variable Annuity Breaking Down the Basics of Retirement Income Fixed Vs Variable Annuity Features of Variable Vs Fixed Annuities Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of What Is Variable Annuity Vs Fixed Annuity Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Pros And Cons Of Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Choosing Between Fixed Annuity And Variable Annuity A Beginner’s Guide to What Is Variable Annuity Vs Fixed Annuity A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity

The index-linked interest is contributed to your initial premium quantity yet doesn't substance throughout the term. Various other annuities pay substance passion during a term. Compound interest is interest earned on the money you conserved and the rate of interest you earn. This implies that interest currently credited also makes interest. In either instance, the rate of interest gained in one term is generally worsened in the next.

This percentage could be used rather than or along with an involvement price. If you secure all your cash before completion of the term, some annuities won't attribute the index-linked interest. Some annuities may credit only component of the rate of interest. The percentage vested normally boosts as the term nears completion and is always 100% at the end of the term.

This is due to the fact that you birth the investment risk rather than the insurer. Your representative or financial advisor can assist you make a decision whether a variable annuity is right for you. The Securities and Exchange Payment categorizes variable annuities as safeties due to the fact that the efficiency is acquired from stocks, bonds, and other investments.

An annuity agreement has two stages: a buildup stage and a payout phase. You have a number of alternatives on just how you add to an annuity, depending on the annuity you purchase: permit you to select the time and amount of the repayment.

permit you to make the same settlement at the same period, either monthly, quarterly, or each year. The Internal Earnings Service (IRS) regulates the taxes of annuities. The IRS allows you to postpone the tax on revenues till you withdraw them. If you withdraw your incomes prior to age 59, you will most likely need to pay a 10% very early withdrawal charge along with the taxes you owe on the interest earned.

After the buildup phase ends, an annuity enters its payment stage. There are numerous options for getting payments from your annuity: Your business pays you a fixed amount for the time specified in the contract.

Breaking Down Fixed Vs Variable Annuity A Closer Look at Fixed Income Annuity Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Fixed Annuity Vs Variable Annuity Matters for Retirement Planning How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Annuities Variable Vs Fixed Who Should Consider Annuity Fixed Vs Variable? Tips for Choosing the Best Investment Strategy FAQs About Fixed Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at How to Build a Retirement Plan

Lots of annuities charge a fine if you withdraw money prior to the payout phase. This charge, called a surrender charge, is normally highest possible in the very early years of the annuity. The cost is commonly a percent of the withdrawn money, and normally begins at about 10% and drops each year until the surrender duration mores than.

Annuities have other costs called tons or compensations. Often, these fees can be as long as 2% of an annuity's worth. Consist of these charges when estimating the cost to get an annuity and the amount you will certainly gain from it. If an annuity is a great option for you, use these pointers to aid you store: Costs and advantages vary from business to firm, so speak to more than one business and compare.

Variable annuities have the possibility for greater profits, yet there's more risk that you'll lose cash. Be mindful regarding putting all your properties into an annuity.

Annuities offered in Texas should have a 20-day free-look duration. Substitute annuities have a 30-day free-look period.

Table of Contents

Latest Posts

Breaking Down Fixed Annuity Vs Equity-linked Variable Annuity A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Pros and Cons of Fixed Vs Variable Annuity Pros Cons Why F

Decoding How Investment Plans Work A Comprehensive Guide to Fixed Vs Variable Annuity What Is Fixed Income Annuity Vs Variable Growth Annuity? Benefits of Choosing the Right Financial Plan Why Choosin

Exploring Deferred Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Benefits of Fixed Index Annuity Vs Variable Annuities

More

Latest Posts